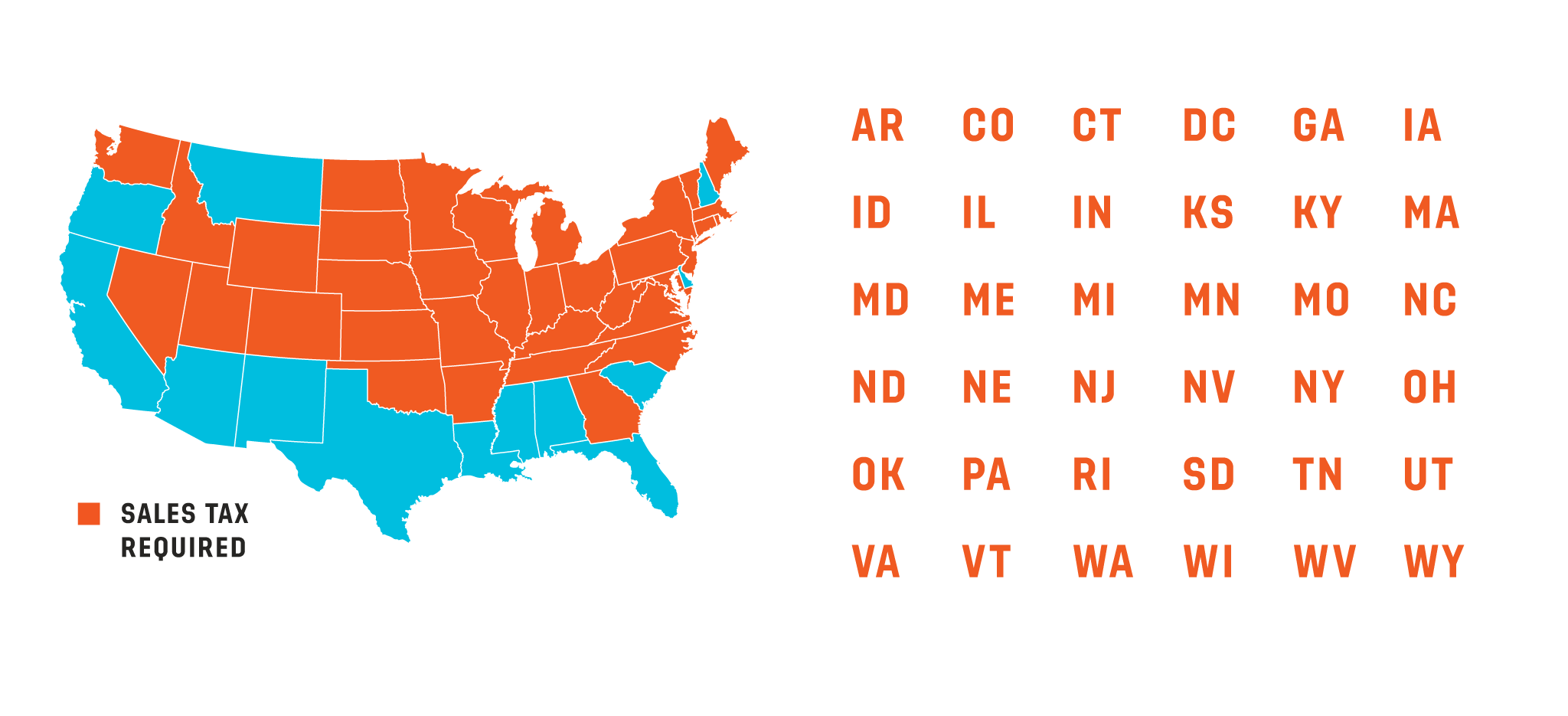

In the wake of a U.S. Supreme Court decision in June 2018, Colorblends is now required to collect sales tax on shipments to the following states, unless we are presented with a resale or exempt certificate (see below).

How Sales Tax Is Calculated and Collected

During checkout, we will use an outside service to estimate your sales tax, including any county or municipal taxes. When we pack and ship your order in the fall, we will look up the tax again (to verify the rate and adjust for changes to the order, if any) before collecting payment. Customers with terms will see the final sales tax on their invoices.

Please note that sales tax may be collected on the shipping and handling charge and the prechill charge (if applicable). The rules regarding what is taxed and what is not taxed vary from state to state.

If you are placing an order during a tax holiday for your state, and flowerbulbs are covered by the tax holiday, you will need to ask us to collect payment before the end of the tax holiday to avoid paying taxes (Colorblends policy is to wait to collect payment until orders leave our warehouse in the fall). Please note that we will not receive a payment request submitted during a weekend until the following Monday.

Filing a Tax Exemption Certificate

If you are purchasing bulbs for resale, as is the case for many landscape contractors, you may file a Colorblends Tax Exemption Certificate. Purchasing agents for tax-exempt organizations, municipalities, and state, federal, and tribal governments may also file an Exemption Certificate.

You will have an opportunity to complete an Exemption Certificate during checkout. Look for the ‘Create an Exemption Certificate’ button in the billing section during checkout.

You will need the resale or exempt identification number your state provides to complete the form.

Businesses and exempt entities need to file an Exemption Certificate only once per year. If you have already filed an Exemption Certificate with us for the current year and you are logged in to the website when you go to check out, the site will remove the sales tax automatically. If you check out as a guest, please leave a note under “Other Instructions” indicating that you have an Exemption Certificate on file. A member of our staff will see the note and remove the sales tax.

You may file an Exemption Certificate at any time until your order ships. After a paid order goes into our warehouse for packing and shipping, we may not be able to claw back sales tax.

Need Help? We’re Here for You

If you need help filling out the Exemption Certificate form or have any questions regarding sales tax, please call us at (888) 847-8637.